Highlights

Polymarket keeps on growing, hires Nate Silver.

Paper estimates causal effects of allowing online gambling, find they substantially increase bankruptcies.

Sentinel, a foresight and emergency response team for catastrophes, gets cofounder and is raising money for growing operations

Overall, things felt a little slow this month, maybe because it’s midsummer in the Northern Hemisphere and people are on vacation.

Index

Prediction markets and forecasting platforms

Polymarket

Markets and the CFTC

Manifold, Metaculus, INFER

New platforms

Research and articles

Odds and ends

Sentinel

Prediction markets and forecasting platforms

Polymarket

Polymarket had >1M views/day (a) for a few days. They hired Nate Silver as an advisor (1, 2 (a)). This probably involves him giving strategic advice and him mentioning Polymarket in his newsletter more often. They got Substack to allow Polymarket embeds (a)

And they started a newsletter at news.polymarket.com (a), aiming to “help you understand the world more clearly through the lens of prediction markets”. Their second article is Gradually, then Suddenly: The Definitive Account of the Biden Dropout Market, a play-by-play account of market movements around Biden dropping out.

In contrast, a large Twitter account tweeted that “theyre [sic] selling dollars for 80 cents” (a). It turns out that the account wasn’t a better information aggregator than the markets.

To give a bit more flavor for newer readers, sometimes people mention prediction markets as being biased—for instance, as having a Republican tilt. But this elides that they also have a population of sharks who will correct mispricings, and that the capital that these sharks have increases, in expectation, with every market. One way to visualize this might be to think of an uninformed mass betting first, in some direction, perhaps with some bias, and then the sharks betting in the opposite direction, to correct the bias. And with every round, the capital which the sharks have to deploy for error correction tends to grow.

Still, you did have Polymarket screens (a) at the Republican National Convention at the end of July. If this really flooded Polymarket, I could imagine that kind of thing being able to introduce some temporary bias, for a while, until sharks catch up to the new capital. And you did see some wackiness on a market on whether Hillary Clinton would announce a run for president: because many online degenerates found it funny to bet on, the price was at 5-8% for a bit, until it became worth it for the market to correct it.

But still, although the story of markets becoming iteratively better has some holes, the market wasn’t selling dollars for 80cts.

Markets and the CFTC

Mick Bransfield covers the timeline of PredictIt’s lawsuit against the CFTC (a). He also shares a paper (a) looking at the short-term reactions in the markets to the 2020 US election, and how they correlate with prediction markets

The CFTC sometimes gets some flak in forecasting circles for not allowing election bets. Here is a reminder that they also take care of all (a) manner (a) of scams (a).

Judge Rowland found Ikkurty’s marketing materials misstated his fund’s historical performance and omitted the fact that the fund fell in value by 98.99% over a period of a few months. Also, the order finds Ikkurty invested in unstable digital asset commodities, some related to carbon offsets, and his actual experience with digital assets consisted of losing his personal Bitcoins to a hack.

Also from the CFTC, they have given permission (a) to Interactive Brokers to not comply with some arcane swaps regulation, because IB’s markets are fully collateralized. Bodes well for IB’s ability to navigate and get along with regulators.

Manifold, Metaculus, INFER

Manifold briefly went down but also did well (a) processing news real-time throughout the transition between Biden and Kamala as Democratic nominees.

RAND acquired (or started managing) INFER a while ago; here (a) is a related article they’ve put out. I still don’t really know where an $8M grant (a) they received went.

Metaculus has a Respiratory Outlook 2024/25 (a) tournament. Its forecasters are sitting at a 15% (a) probability of human to human transmission of H5N1 before 2026. Otherwise, Metaculus’ AI forecasting benchmark tournament went live.

New platforms

PlayMoney is a prediction market platform. It started as a fork of Manifold when it announced its pivot to real money markets, but later became its own thing.

predx.ai (a) is an AI × prediction markets startup. They have some “testimony” from “David, employee of Open AI”: “I wish to trade on the probability that Sam will become the CEO again, even though he is fired.” I find it so scammy it’s funny. Their markets page (a) looks pretty smooth though. They reportedly raised $500K (a).

4cast.win (a) is a Skinner box (a) with a retro-computing skin where participants can bet on short-term crypto price movements with a prediction market interface.

Research and articles

A new paper (a) looks at the effect of a US Supreme Court decision (a) repealing a federal ban on sports gambling on measures of consumer financial health. After the ruling, states legalized gambling, but not at the same time, so one could try to use this to estimate a causal effect by looking at differences in differences. The paper uses data from the University of California (a), which paid one of the big three “consumer reports” companies in the US—Equifax, TransUnion, Experian—for access to detailed financial data on 7M Americans, or 2% of the population (the data also covers 100% of Californians). Authors filter this data down to 4.3M data points.

The standard concerns about gardens of forking paths and imperfect adjustment for cofounders apply. The authors try to test for states legalizing gambling at the points where they want its revenue the most, and think it’s not a concern, but you could still have things like more fiscally conservative states both legalizing gambling later and doing better through COVID. In any case, they find that legalizing gambling has generally bad effects, particularly if online gambling is also legalized, and particularly for young & poor adults. If I’m reading figure 3 correctly, they estimate that legalizing online gambling increases the probability of bankruptcy by ~0.025%, from a baseline of ~0.09%. One of the authors has a twitter thread (a) highlighting other key results.

A normal CBS article (a) talks about Here’s what investors are saying about Biden dropping out — and what it means for your 401(k), which casually mentions Polymarket. I might mention it next time someone asks me about the social utility of prediction markets: Americans’ everyday economic planning is affected by big-picture political shifts, in Presidential and Congress elections, and prediction markets offer a better accounting of uncertainty.

The Wall Street Journal had two (a) articles (a) covering prediction markets.

Vasco Grilo has continued writing a bunch of Fermi estimates (a).

Odds and ends

adj.news (a) is an RSS reader that combines normal RSS feeds with related prediction market. You can sign up for its private beta here (a) with the code “adjacent_beta”. Overall I think the idea is somewhat interesting, but I’m not particularly keen on RSS+prediction markets in particular, as opposed to the broader space of “integrating prediction markets more everywhere” (browser extensions, easier search, easier bets, etc.) Partly this is because I’m very attached to my Linux RSS reader in particular.

A viral thread on Twitter (a) attacks using forecasting for predicting AI risks. Although I agree with much of it, I think in practice the alternative they are proposing is ideological big-picture thinking, which I think is probably worse. Still, authors promise to consider alternatives in a subsequent post.

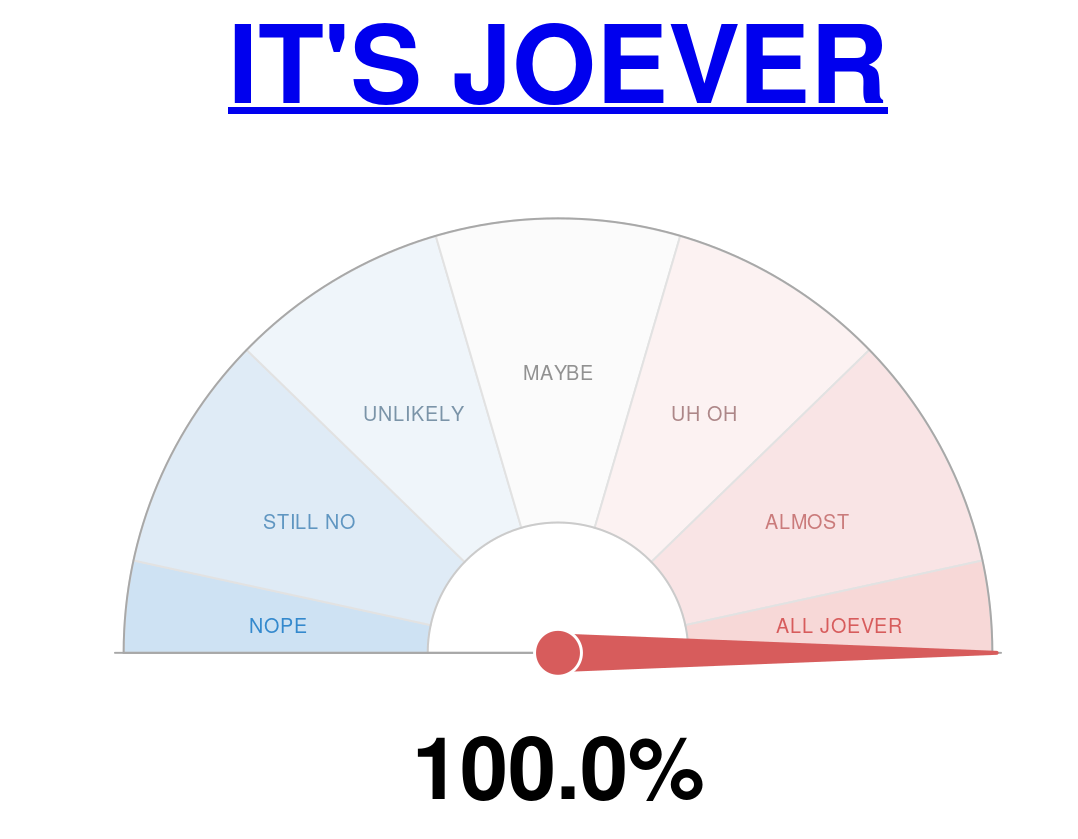

Andrew Gritsevskiy (a) and Derik Kaufman (a) built a cute site: is it Joever (a), to track whether Biden would withdraw from the Democratic convention.

The Right Wing Reddit clone patriots.win (a) discusses Polymarket odds for the US presidential election.

One argument for allowing political bettor in the US is that in the UK and European Union, it’s perfectly legal and things work fine. But the UK recently had a minor scandal when an aide to the Prime Minister placed a small bet (a) on the announcement on early elections. “The system worked, though”, and the bet was flagged (a)—hence the scandal.

Sentinel

Sentinel (a)—a foresight team and emergency response team trying to see catastrophes coming beforehand and be able to react against them—is still going strong. You can read the minutes for weeks #27 (a), #28 (a), #29 (a) and #30 (a), as well as a case study (a) of a German doctor who created a vaccine early on in the pandemic but was initially prevented from distributing it by the German state. We now also have a Twitter (a).

At the advice of Vishal Maini (a), I will most probably go full time on Sentinel, rather than continuing with the current lean and mean version subsidized by my profitable estimation consultancy (a). I’ve also recruited a cofounder, Rai Sur (a), who has committed to going full time on Sentinel for an initial three months. He was previously an engineer and Microsoft, an Ethereum core developer, and then worked on various crypto startups. I consider him very competent in general, but I also see his personality as complementary to mine, and I’m excited about what I can do with more of a Steve Jobs to my Wozniak.

We are currently raising funds to spend about a year working on Sentinel. Reader, if providing funds & patronage to this is something you might want to do, please get in touch at hello@sentinel-team.org, on Twitter (a), or elsewhere.

If I had to put my money where my mouth is, my mouth wouldn’t be very busy. I’m just sayin’…

This newsletter is sponsored by the Open Philanthropy Foundation.

> Metaculus has a Respiratory Outlook 2024/25 (a) tournament. Its forecasters are sitting at a 15% (a) probability of human to human transmission of H5N1 before 2026.

Keep in mind, we're predicting CDC saying that there is "probable" h2h transmission, as they've done several times before: https://www.cdc.gov/bird-flu/php/avian-flu-summary/h5n1-human-infections.html . Most of us don't believe that this will correspond to actual h2h transmission.

congrats to rai (& you)!