Humans still crush bots at forecasting, scribble-based forecasting, Kalshi reaches $2B valuation | Forecasting newslettter #7/2025

and possible big incoming tax hike coming to US-based bettors (a).

Highlights

Metaculus finds that human pros still crush bots (a) at forecasting.

Dynomight on scribbles-based forecasting (a). Try it here (a).

Possible big incoming tax hike coming to US-based bettors (a).

Prediction markets and forecasting platforms

Kalshi

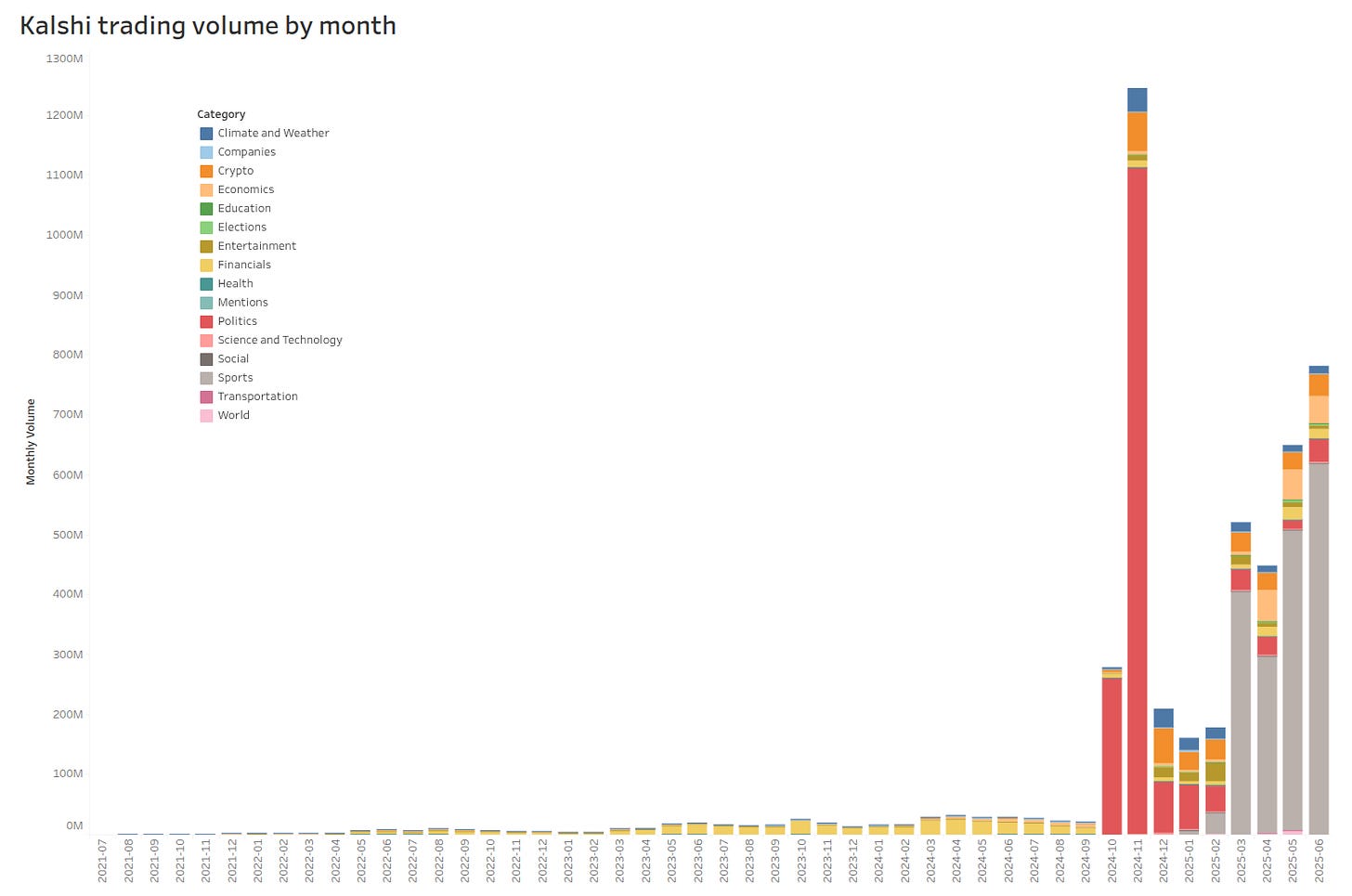

As Kalshi turns 4 (a), sports and elections dominate, to the extent that now it’s not a prediction market with sports attached but the reverse. The platforms reached a $2B valuation after getting 185M (a) in funding. And FanDuel (a gigantic betting company) might collaborate (a) with it.

But Kalshi’s continues to be challenged; this month most strikingly on the government side by a coalition of 36 attorney generals (a).

Polymarket

X officially partnered (a) with Polymarket. For now this involves integrating X and X.ai into Polymarket (a), rather than the reverse! Polymarket might (a) now raise $200M at a $1B valuation. It also launched another Polymarket Open Builders (a) contest.

Polymarkets news site (a) is pretty interesting, with articles on an open source automated market maker (a), betting on Zohran and saying that Somalia will fall (a), talking with a shipbroker (a), and featuring Sentinel’s own belikewater on Iran (a).

And military insiders might be betting (a) on Israel strikes (a).

Metaculus

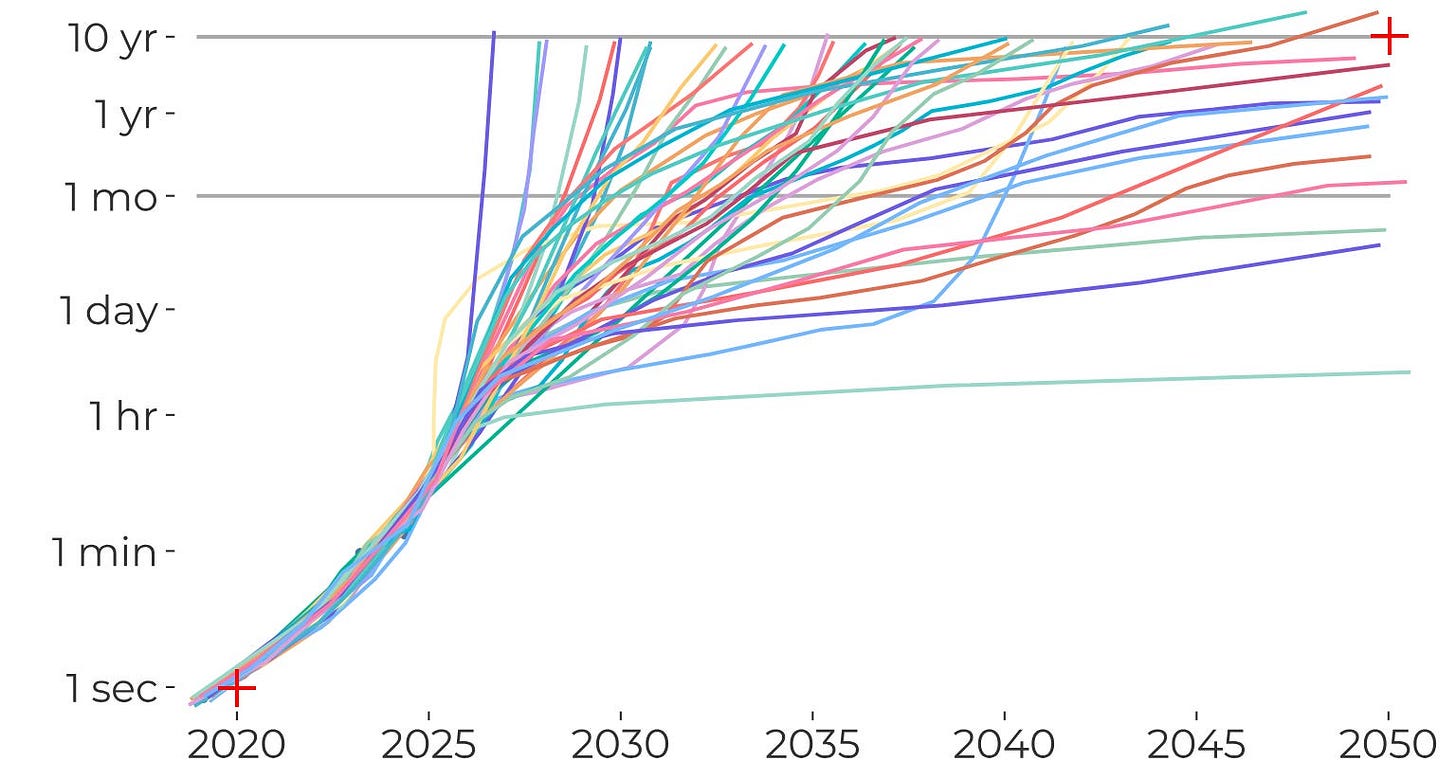

Metaculus finds that human pros still crush bots (a) at forecasting. And it gathered (a) some questions related to the AI 2027 (a) scenario.

Others

PredicXion launches (a) an Asia prediction market. Here is another alpha version (a) for a prediction market.

Manifest (a) was very neat. I mostly talked with people, rather than attending talks. I would really recommend attending next year if you’re part of the forecasting community, broadly construed.

Research and articles

Avoiding Obfuscation with Prover-Estimator Debate (a) (summary (a)) proposes a schema to incentivize truth by breaking down top-level assertions into smaller chunks. Some of it goes over my head, but overall seems cool & interesting.

titotal critiques (a) AI 2027’s models.

Reference class problem coupled with weak evidence makes for radical uncertainty for p(doom), writes Simas Kucinskas (a).

RAND has a cogent article on OSINT, although I’m not sure what to make of the examples mentioned (monitoring Russia’s disinformation campaigns, assessing the risk of pandemics being weaponized, and tracking political instability in Africa).

On the reinsurance industry pricing pandemic risk (a).

“[A]ll models failed to beat the market in the headline contract but some did so convincingly in contracts referencing less visible races” for the 2024 election, finds this paper.

A one year retrospective (a) on Aschenbrenner’s Situational Awareness.

The Forecasting Research Institute looks at Forecasting LLM-enabled biorisk and the efficacy of safeguards (a).

Odds and ends

Dynomight on scribbles-based forecasting (a). Try it here (a). Rather than have a quantified model for a fairly subjective judgment, you can write 50 lines of plausible futures and then infer the probability distribution from there. I think this is pretty genius.

According to various European betting sites, JD Vance is the favorite (a) for the 2028 election.

NYT is hiring an elections analyst for $113K to $155K (a).

At Sentinel, we continued tracking large-scale risks (a), with an eye to the conflict between Iran and Israel/the US. In my mind, risk of a tail catastrophic outcome was centered at the beginning, when there would have been some chance for China and Russia to intervene. But that window closed pretty fast.

askaforecaster.com (a) was mentioned by Scott Alexander (a), leading to a bunch of new asks. I find it deeply meaningful to answer forecasting questions that are so relevant to people’s lives that they’re willing to fork over $20-$150.

Lawfare

A tax change in the Big Beautiful Bill would wreck (a) frequent bettors and prediction market players in the US, by capping deduction of losses at 90% of the loss amount. If the best bettors are also law abiding, this might lead to a small decline in the accuracy of Polymarket and Kalshi.

PredictIt and the CFTC are reaching a settlement in principle (a) for their longstanding dispute.

Railbird received CFTC approval as a designated contract market. Potentially a fairly big deal, as it would weaken Kalshi’s grip on prediction markets in the US.

New York Attorney General Letitia James sent cease-and-desist (a) letters (a) to 26 sweepstakes sites in the state.

News

Hurricane forecasters are losing (a) 3 key satellites ahead of peak storm season. Could be a big deal (a).

Sports betting stocks fall after Illinois adopts tax hike on betting. Wyoming is also considering a sportsbook tax hike (a).

DraftKings launched (a) its own PAC to further gambling industry causes.

It’s Not Gambling, It’s Predicting, comments Matt Levine.

Bayesian statistics require priors. Forecasters can provide those priors.

—Eva Vivalt, 2022

> If the best bettors are also law abiding, this might lead to a small decline in the accuracy of Polymarket and Kalshi.

regardless of de facto realities touched on in Matt Levine's article, Kalshi contracts are de jure classified as CFTC-regulated derivatives (not gambling)

If anyone actually has the patience to do all the clicking and make your own scribble-based forecast, I'd love to hear what you get.