Forecasting newsletter: June 2024

Interactive Brokers entered the arena, Polymarket new ATH, Manifest whiplash, process to stop political prediction markets in the US still stoppable

Highlights

Interactive Brokers opens forecast exchange

Polymarket usage reached new all time highs

Manifest loved by participants but Guardian hitpiece leads to Moskovitz strategy change

CFTC still open for comments on proposed rule forbidding political prediction markets

Prediction markets and forecasting platforms

Interactive Brokers announces a forecast exchange (1 (a), 2 (a), 3 (a)). Duly registered with the US CFTC (a). Trading began yesterday, Monday, July 8, 2024.

So far, they have thresholds on commodities (a) and will have trading on economic indicators (a). Here (a) with Interactive Brokers’ CEO, in which he mentions that he has been wanting to try this kind of thing for the last ten years, and that he sees it as a mechanism for incentivizing a more analytical approach to questions that are otherwise more politicized.

Because Interactive Brokers is so huge: 2.92M (a) users, it might become the biggest player in the prediction markets space by dint of being the first large institution to show up. They were advertising markets in their frontpage like this:

They are also paying interest on money locked in these contracts:

ForecastEx forecast contracts earn interest income based on the closing market value of the positions. Interest accrues daily and is paid monthly. Interest earned is currently paid at a rate of 4.83% APR.

Example: If you purchase a position at USD 0.50 and the market closes at USD 0.50, the daily interest accrual will be based on USD 0.50. If, on the following day, the market for the same contract closes at USD 0.70, the daily interest accrual will be based on USD 0.70.

Sadly, their market only seems to be open to US-based customers, and doesn’t yet serve UK or international clients.

PredictIt instituted minimums (a) in some (a) contracts:

PredictIt is required to cap the number of traders in any one contract at 5,000 as a condition of our operation. Our minimum ownership requirement is designed to preserve liquidity and the opportunity to establish, modify or liquidate market positions in our busiest contracts that could otherwise reach the 5000 limit.

DC District Court judge returned (a) the Clarke/PredictIt v CFTC (a) lawsuit back to the Western District of Texas, where it should have a much better chance.

Metaculus will go open source (a) in Q3. They also have a $120k AI forecasting benchmark contest (a) to compare AI forecasters against humans.

Manifest is a forecasting and prediction markets conference, now on its second year. Here are reviews from Theo Jaffee (a), Ozzie Gooen (a), James Bailey (a) or Kalshi (a).

The Guardian published a hit piece (a) about Manifest platforming racists and other undesirables. Here (a) is a response at Quilette. An EA forum post brings up similar points, and Austin Chen replies, but he has lost Peter Wildeford.

The Manifest backlash seems related to a cryptic update (a) about a change in funding priorities from Dustin Moskovitz—the largest funder behind Effective Altruism. I found these two (a) comments (a) from him particularly informative:

My view is that rationalists are the force that actively makes room for it [editor: it = fringe opinions] (via decoupling norms), even in “guest” spaces. There is another post on the forum from last week [editor: another post = this] that seems like a frankly stark example.

I cannot control what the EA community chooses for itself norm-wise, but I can control whether I fuel it.

I’m not detailing specific decisions for the same reason I want to invest in fewer focus areas: additional information is used as additional attack surface area. The attitude in EA communities is “give an inch, fight a mile”. So I’ll choose to be less legible instead.

To me, the above seems like a bad way to steer a 10k strong community composed primarily of nerds to their maximum potential. Readers might also be interested in this post of mine about Unflattering aspects of Effective Altruism (a). Being less legible also doesn’t seem like a long-term equilibrium. Instead, actions are likely to bleed information (a).

On this note, now also seems like as good a time as any to disclose that this newsletter is receiving funding from Open Philanthropy—the foundation which gives Moskovitz’s funding away. It was a legible proposition to them and it allows me to spend time on things I consider more valuable, like Sentinel (a). Readers may have noticed that paid subscriptions have been disabled for a while.

Here is an interview with Polymarket (a)’s most prolific trader, Domer. This same trader also covers how the US presidential debate impacted betting odds in real time here (a)

Polymarket released (a) a repository (a) allowing users to get loans based on their positions. This allows leverage. They haven’t deployed to production, though, but rather present it as an example of a project someone could do.

This dashboard (a) shows some stats for Polymarket: $45M value locked, and $137M volume in the last 30 days. A different dashboard (a) gives $112M for June and $44M for July already as I’m writing this.

I found Roaring Kitty billionaire by Friday? (a) particularly amusing, and Will Israel invade Lebanon before September? (a) particularly informative.

Two markets on Is $DJT real? (a) and Was Barron involved in $DJT? (a) led to some prediction markets drama, and Polymarket ended up reimbursing (a) “Yes” holder for the second market. I’m writing a profile looking at that in more depth.

Hypermind sent me 15 emails wanting me to participate in some AI related forecasting, but when I finally clicked, their page led to an error.

Azuro is a protocol which presents itself as providing Lego blocks for building prediction markets on top of the Ethereum Virtual Machine. I haven’t evaluated it in depth, but it struck me as interesting.

Kalshi has a bunch of bug bounty programs. The market (a) and contract bug (a) rewards seem decent, but the technical vulnerability bug bounty program (a) seems a bit weak and undefined.

Odds and ends

The CFTC extended (a) the period for commenting on their proposed rule-making disallowing political prediction markets. You now have until the 8th of August to make a comment (a).

Vasco Grilo, an EA known for his straight-shooting estimates across a wide spectrum of altruism-related topics (a), bets Greg Coulbourn $10k that AI will not kill us all—he paid upfront and will be getting $20k inflation adjusted. There is some discussion in the posts’ comments about whether Greg Coulbourn had better options.

The same Vasco fits (a) various distributions to historical deaths.

adj.news (a) is a sleek-looking combination of RSS and prediction markets.

Colin Fraser looks at 538’s calibration (a), and finds that their good calibration is particularly driven by them being good at house races, as well as by a few artifacts.

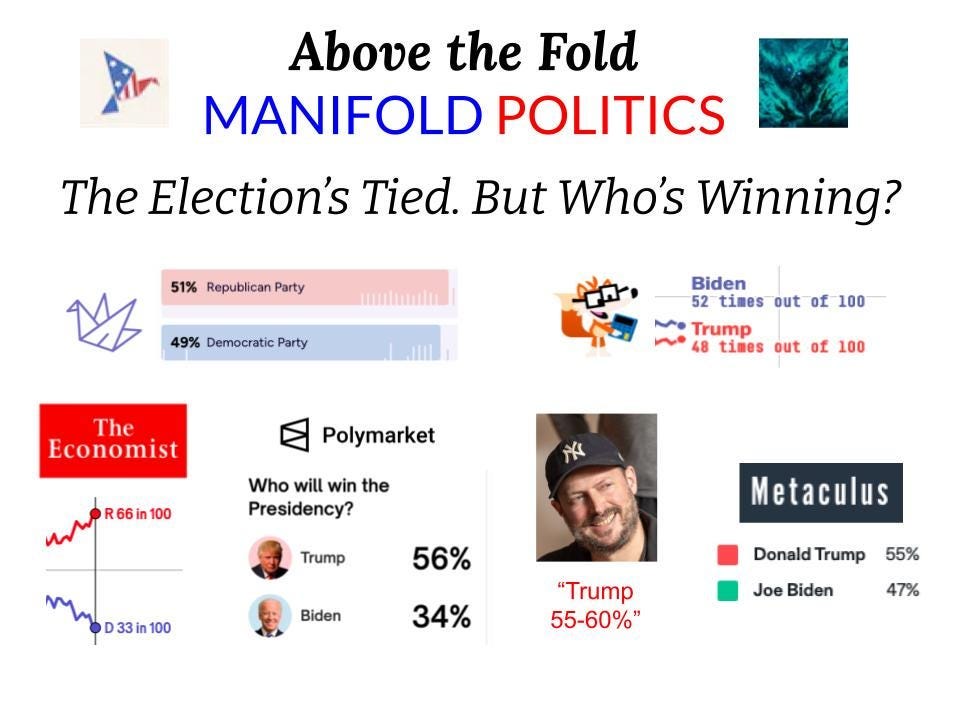

Manifold vs. 538 vs. Everyone Else: Comparing 2024 Election Forecasts (a). Different models give different answers, and the new, post-Nate Silver 538 model gives Democrats a higher chance based on the “fundamentals”. I’m particularly glad that it summarizes existing models:

Subjectively, odds are now routinely covered by mainstream (a) media (a) much more often than in the 2020 election.

Here (a) are some forecasts from the UK government on student loans.

A risk management expert seems very happy that you don’t need to worry about which distribution to use any more (a) because of MakeDistribution (a).

By the maker of MakeDistribution, here (a) is a calculator to estimate how much you should bet, assuming constant relative risk aversion (a).

This site (a) compares the calibration of different platforms. The same author, wasabipesto (a), has an interesting website, and generally seems underrated.

An extensive exploration of the snake eyes paradox (a).

I’ve continued to run Sentinel, a foresight team and an emergency response team meant to be able to see catastrophes coming a bit beforehand, and perhaps be able to react to them. You can read the weekly minutes from the foresight team here; they summarize the highest risk events each week.

I came across this paper (a) which explores how deep neural networks approximate Bayesian posteriors.

Jesse Richardson proposes Prediction Market Trading as an LLM Benchmark (a) as having low barriers to entry, unlikely to saturate, and corresponding to real capabilities.

This paper (a) looks at quantifying the impact of the prior on a final prediction.

Here is a defense of HFT (a), as reducing spreads and acting as a low-level optimization layer for finance.

You have no choice but to accept that the major conclusions of these studies are true

—Daniel Kahneman (a), referencing priming studies which have now not replicated.

My impression as somebody who formerly had an IB brokerage account is that you can trade everything on their platform, no matter where you are. That was five years ago, though, and might have changed.