Forecasting newsletter for September 2024: Political betting live in the US

Political prediction markets live in the US on Kalshi and Interactive Brokers. Manifold markets introduces monetary payouts under a sweepstakes model. And a look at a previous prediction markets cycle

Highlights

Political prediction markets live in the US on Kalshi and Interactive Brokers

Manifold markets introduces monetary payouts under a sweepstakes model

Index

Prediction markets and forecasting platforms

Greeting from 2008-2015 prediction market cycle, netizens

Manifold

Polymarket

Metaculus

Kalshi

Other platforms and markets

US regulators and courts

Research and articles

Odds and ends

Prediction markets and forecasting platforms

Greeting from the 2008-2015 prediction market cycle, netizens

I found myself going through back issues of the Journal of Prediction Markets (a). The last few years don’t have much that is interesting, but, for instance, a 2009 issue (a) has an article writing up Inkling’s perspective (a); the entity which is now Cultivate Labs.

From there, I found the Inkling markets blog (a). It’s a blast from the past. They built in public before it was cool, and although they were using now-ancient technologies (a), they still managed to have some features that current alternatives, like Manifold Markets or Polymarket, don’t yet have.

I know that some autists at other platforms obsessed with customer experience will also read through the whole blog looking for insights. For the rest of you, here are some of the posts I most enjoyed:

On features: giving users the ability to make their own markets (a) in 2006, follow up in 2007 (a); tags, 2006 (a); adding RSS (a), RSS part II (a) in 2007; date markets (a); adding a comment section (a) in 2008; cloning markets (a), quick trade (a), trading directly from email (a) in 2009; stats page for each question (a) which show the percentage of portfolio invested, calculating net worth incorporating slippage (a) (Manifold doesn’t do that); misc improvements in 2010 (a), 2011 (a)), an iOS app (a) in 2012; time frame markets (a) in 2015.

Media mentions: 2006: WSJ, CBS; 2007: The Economist, NYT, Herald Tribune, New Yorker, The Globe and Mail; 2008: CNN political markets; NYT.

Interactions with Google (a), Reddit (a) Yahoo (a), justin.tv (a), O’Reilly (a)

Appreciating (a) a particular user; interview with a trader, 2007 (a)

Looking at their own calibration (a)

Particular types of markets: government procurement (a), water industry (a); prediction markets at the beginning of the Obama administration (a); projections on U.S. Senate Race, 2011 (a); Oscar prediction iPhone app (a)

Inking now the leading information technology company in the universe (a)

A few old screenshots (a)

Inkling’s final chapter (a) on reflections about the whole thing.

Manifold

Manifold introduced monetary payouts (a) with “sweepstakes” model. It’s limited to selected markets, and are resolved only by Manifold. Non-US residents are not eligible (yet?), and users have to complete a KYC questionnaire, per the FAQ (a)

Manifold Markets newsletter covered the presidential debate (a).

Polymarket

The Information reports that Polymarket is in talks to raise $50M+ in new capital, and considering launching a token. This comes after a $70M raise (a) revealed earlier this year. It’s pretty significant that Polymarket seems able to recruit that much capital, but also that it finds a need to.

Polymarket seems to have outperformed professional economists (a) in predicting the magnitude of Fed interest rate cuts.

I’ve seen some articles touting that Polymarket reached $1B in election trades. I consider this stat ignorable, since it counts back-and-forth trades, which Polymarket somewhat incentivizes through their liquidity programs. Instead, the stat I like is total value locked—also called open interest—since these are more difficult to juice—since the opportunity cost of keeping money in a contract is pretty high these days. Per DefiLlama or Dune, Polymarket has about $140M value locked, which is also on an exponential trajectory.

Polymarket had markets on whether Israel would invade Lebanon before September, in September (a), before November (a). I have been finding these useful to get a sense of how the situation develops. The September market’s resolution mechanism is in the process of deciding whether Israel conducted a “proper invasion”.

Polymarket’s newsletter covers odds shift (a) during the presidential debate. And traders attempted to manipulate (a) a derivative market on Polymarket, but did not succeed.

Metaculus

The CDC partnered with Metaculus (a) to collect expert forecasts for this respiratory season, and Metaculus looks at the track record of bots (a).

Kalshi

Kalshi won a victory in court, but the CFTC asked for a stay in execution (a) (a delay), which was granted. The result is that Kalshi’s political markets (a) didn’t include the result of races for most of last month.

Per the Kalshi Discord, election trading was initially open on Friday the 13th of Sept from 12:47 AM to 2:37 AM. They then resumed (a) on Oct 2nd, and now have presidential election (a) markets live.

Other platforms and markets

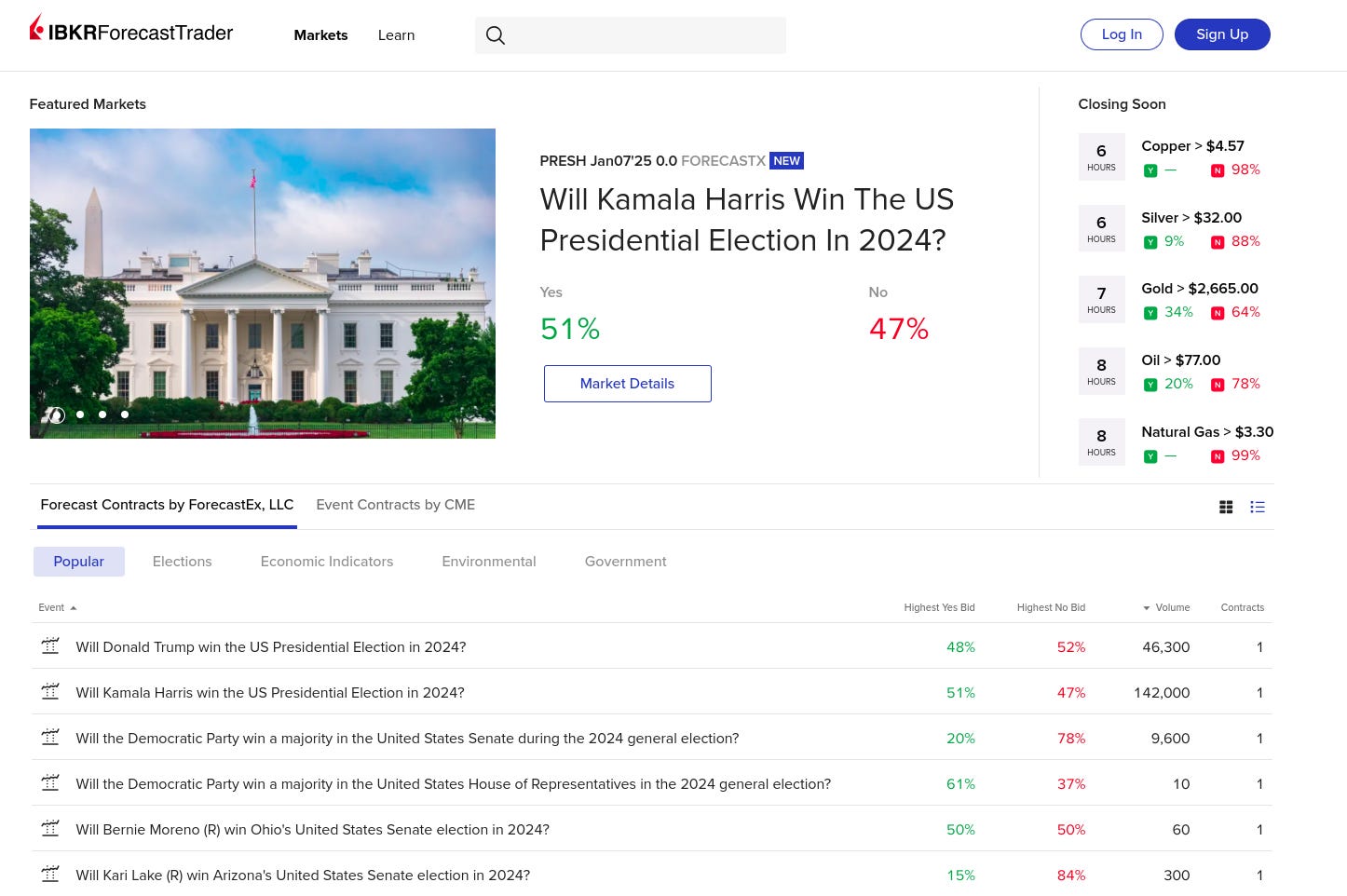

Interactive Brokers, also briefly announced (a) it would offer such markets, and now, almost a month later, has presidential markets as well as many others (a). Their markets page is slow to load, which could be killing their user conversion rates in these fast-paced times.

RAND’s acquisition of INFER continues (a).

Hypermind, a minor player, struggles with relevance and almost-certainly-falsely claims that “no other market, crowd or model has a better track record” when referring to their probability map for the US elections (a). In particular, 538/Nate Silver probably has a better & longer track record.

Various prediction markets are offering leverage on US election betting: 3x (a), 10x (a), 20x (a). The last one raised $4M (a).

forecastforfun.com (a) is a neat & small paper money prediction market, which mimics some of Polymarket’s largest markets.

Limitless markets (a) raised $3M (a). They’re specializing on fast-paced and user-created markets.

Cultivate Labs’s newsletter (a) has a few updates on the organization, and covers their collaborations with RAND, Bertelsmann, or the Canadian Forest Service.

US regulators and courts

Republican House Judiciary Committee Chair Jim Jordan questioned the CFTC (a) (full letter (a)) over whether it lawfully prohibited political prediction markets.

The Motte—a site for pretty extreme online disagreeables/decouplers—has some reflections on the legalization of gambling in the US, in the context of answering the question “what have you been wrong about”: 1 (a), 2 (a). The comments on gambling legalization add color and are insightful, but they are also surrounded by opinions some readers of this newsletter might find distasteful.

Here (a) are the oral arguments in the CFTC’s appeal of the ruling granting Kalshi the permission to host political markets.

Browsing old links, I also found The folly of making political prediction markets like Intrade illegal, by Eric Zitzewitz:

A consultant told me about a software company that ended an internal prediction market that forecast the success of the company’s products. The problem was not that it failed to work ‑ it worked all too well, and that raised awkward questions for the egos involved.

Fortunately, politicians never green-light flops. They never launch wars, or social programs, that turn out to be expensive and unsuccessful. They never back a weak general-election candidate in the primary.

Oh, wait ‑ they do that all the time. And in their assault on prediction markets, they take away one of the most promising tools we have for identifying their next mistake in time to stop it.

Research and articles

Dan Hendryks published some work (a) on “super-human” forecasting, and claims that “AI forecasters will soon automate most prediction markets”. Whether the claim is accurate depends on whether you are sandbagging the comparison against human forecasters. Data contamination issues are also a concern, though the authors tried to avoid this. Overall it seemed kind of sloppy. Some rebuttals: 1 (a), 2 (a), 3 (a), 4 (a). Overall I find this concerning because Hendryks has some influence in general and with Elon Musk in particular, and the rest of his work is harder to judge.

Anyways, Metaculus is running a well-thought out comparison (a) between bots and their pro forecasters, and has tried to do a light pre-registration of methodology. We’ll check at later this year to get some better, less sensationalist data on how bots compare to humans. The Forecasting Research Institute has a similar paper trying to compare LLMs vs humans and against each other (a), though with some questionable details, like using Manifold markets.

Vox has a good profile (a) on Nate Silver, as both a forecaster and the pundit.

A study looks at how climate change markets could be manipulated (a), and ends up favoring the conclusion that market participation should be restricted. To me this gets things very wrong, because a) you don’t know who is or isn’t manipulating markets (e.g., Republicans widely think that the academic market is corrupt), and b) the iterative nature of prediction markets means that those who are correct will end up gathering more capital, in a way which wasn’t captured by the small lab experiment.

Rajiv Sethi corrects the CFTC’s citing of his paper on the Romney Whale (a). Andrew Gelman follows up (a).

The Cook Political report has a “demographic swingometer” (a) which allows exploring scenarios depending on how different demographic groups turn out.

Betfair has a really neat analysis of US swing states.

Odds and ends

The software side of prediction markets is commoditizing. Ross Pfeifer has been building a prediction market using Cursor/Claude and recording his progress on YouTube (a). He launched at etcbet.xyz (a); oddly enough on the Ethereum Classic (a) chain. The guy seems earnest, and I wish him the best. At the same time, I’m not particularly expecting him to pop off. I guess the best case scenario is for him to collaborate with a larger project. Another guy (a) created a prediction market running on telegram in a few days.

Pratik Chougule (a) on the importance of building a political betting community:

The more we can build the political betting community, the more that every other thing we want will follow. The regulatory restrictions will break down. We’ll have more liquidity in these markets. We’ll have more competition. We’ll have better lines. All of it will come together.

Ben Wilson is offering to build custom research tooling, like this AI forecaster (a) or this baserate generator.

Here (a) is a tool to input probabilities for AI doom. I don’t particularly think that doom is as disjunctive as this makes it seem, but neat nonetheless.

Robert de Neufville is organizing a Superforecaster chat on the US elections, details here (a).

I have a Twitter thread with Fermi estimates here (a).

The DC forecasting meetup went well, with 18 total attendees, including a Senate staffer. Their next one is being decided here (a). They also raised a bit over $600 on Manifund (a).

Interactive Brokers founder interviewed on election futures (a).

The most heeded futurists these days are not individuals, but prediction markets, where the informed guesswork of many is consolidated into hard probability. Will Osama bin Laden be caught in 2008? Only a 15% chance, said Newsfutures in mid-October 2007. Would Iran have nuclear weapons by January 1st 2008? Only a 6.6% chance, said Inkling Markets. Will George Bush pardon Lewis “Scooter” Libby? A better-than-40% chance, said Intrade.

—The Economist, the future of futurology, 2007

This newsletter is sponsored by the Open Philanthropy Foundation.