Forecasting newsletter for August 2024

The eye of the world turns to the US elections, and Polymarket captures its attention. Imitators pop up but don't have a great story for why they're better.

Highlights

The world is extremely interested in the US elections, and Polymarket probably has the market with the highest volume on the topic. This attracts imitators, but they mostly don’t have a great story for why they’re better

Kalshi, the CFTC, PredictIt and the US courts continue playing it out.

After years of limping along, Augur dies.

Index

Prediction markets and forecasting platforms

Sayonara, Augur

Polymarket, then and now

Other platforms

US regulators and courts

Research and articles

Odds and ends

Kant on degrees of belief

Prediction markets and forecasting platforms

Sayonara, Augur

I checked on Augur, an early crypto prediction market. Over the last few years, it has died a slow death.

Years ago, the initial developers raised $5.3M (a) in an “initial coin offering”. They pioneered prediction markets on Ethereum, then decentralized (a) the project. The user experience was janky, so some developers independently built catnip (a) with curated markets on top of the Augur protocol, around the time of the 2020 election. There was an Augur V2, an Augur Turbo, an Augur Sportsbook with no real comparative advantage.

Its Github (a) is inactive and the token is at 37cts:

There was no clear point until now at which I noticed Augur had definitely died. By 2022 it was less convenient than Polymarket, by 2023 it wasn’t dead yet. Now augur.net is down and it has taken me more than a month to notice.

Polymarket, then and now

Four years ago, Forbes reported that a bet of £52k (a) moved odds appreciably. Here (a) is a memo for Polymarket investors from that year.

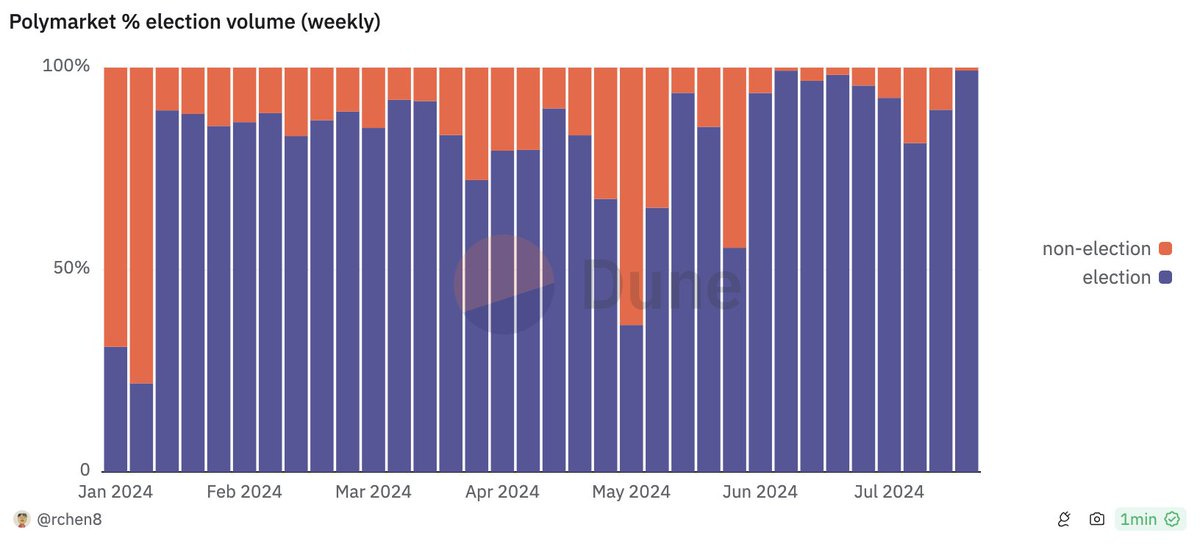

Now, Polymarket has $100M in open interest, and 70%+ (a)/88% (a) of volume seems to be tied to election markets. Today, 52k, of whatever currency, doesn’t move the odds much. And even if most of the volume is tied to elections, Polymarket does other interesting things, like calling (a) Twitter being banned in Brazil a bit beforehand.

Polymarket also recently partnered with Perplexity (a) and Bloomberg (a) to incorporate markets into their respective products. Kalshi incorporated their markets into Bloomberg back in 2022 (a), but I don’t know what came of that.

Polymarket’s newsletter, The Oracle covers, the US election market, Telegram and a potential Israeli invasion of Lebanon, then job market numbers, chance of a recession, and

Prediction market player Domah (a) covers Polymarket’s resolution of the Venezuelan election, where the Maduro regime probably lost in terms of the number of ballots, but got his loyal Supreme Court to certify the election in his favor. Polymarket initially resolved their market in favor of Maduro, but the resolution was disputed, and it eventually resolved (a) in favor of Maduro’s opponent. Domah also complains about (a) or covers (a) the resolution of a contentious market on whether RFK would drop out. the resolution of a contentious market on whether RFK would drop out.

The impression I get is that on ambiguous Polymarket markets, people are predicting and betting on their ability to influence the UMA mechanism resolution mechanism as much as on the event itself.

Other platforms

Manifold’s “Above the Fold” newsletters covers the surprise DNC guest and the RFK drop out markets (a), the choice of Tim Walz as VP (a), and invites readers to the Manifold Election Day Watch Party in Berkeley (a).

Manifund has an EA-branded funding round (a) which has some forecasting projects. Two of them involve starting their own forecasting platform, PlayMoney (a) and SocialPredict (a)

JuliusHege on Good Jugment Open (a) plots the distribution of electoral votes as predicted by different platforms:

YuehanSimizi asks why not now? (a) on another North Korean nuclear test: “if we were to ask if North Korea will, some day, conduct another nuclear test, I think most of us would say ‘’almost certainly.’’ Which means the question”why not now?” is also valid, especially when past practice indicates that they’re overdue for one.”. I disagree (a) with him on how one should model this, but think it’s an interesting question to ponder. The Good Judgment Open crowd is at 68% that North Korea won’t detonate a nuclear weapon by August 9th of next year.

Kalshi was hiring promoters at the DNC, for up to $200.

Metaculus introduced “Minitaculuses” (a); akin to subreddits for the Metaculus platform.

I’ve come across various new prediction markets. I don’t vouch for them. I don’t even know how to access a few of them. They are: nodo (a), predict.fun (a), Drift Trade’s bet (a) (2 (a)), delphi.market (a) (2 (a)), tradex (a), vega (a).

These new contenders don’t generally strike me as being better than Polymarket. But Polymarket’s success has blazed a trail, and now we’re seeing imitators and VCs smelling opportunity. The imitators will probably end in the long list of failed prediction markets (a).

US regulators and courts

Blanche Lincoln, a former Senator from Arkansas, rebuffed (a) the CFTC on their interpretation of her comments, which the agency was using to argue for a political prediction markets ban.

Elizabeth Warren and other members of the US Congress wrote a letter to the CFTC (a) opposing political prediction markets.

The Coalition for Political Forecasting has a thoughtful letter to the CFTC (a) that could serve as a reference for future prediction market advocates. The first ten pages are self-contained comments on recent events.

The PredictIt case likely won’t be argued before the courts (a) until 2025.

The CFTC granted Kalshi license (a) to be a derivatives clearing organization (a). This is apparently a moderately big deal, as it will allow them to operate at more levels of the financial stack. Kalshi might also be offering interest paid on positions (a). So far, they have given a heads up to their users that they’ll move away (a) from their previous clearinghouse.

I’m not super into the weeds, but to me the story in broad strokes is that Kalshi has convinced regulators that experimental financial instruments require heavyweight licences and then acquired those licenses. In the process, they have made most of their competitors illegal or ambiguously legal, but also connected prediction markets to the broader financial world and set themselves up for expansion. If regulators hadn’t been asleep at the wheel, instead of picking a winner in Kalshi, they could have emphasized more lightweight no action letters or de minimis exceptions that allow for experimentation, while charting a roadmap for successful experiments to acquire more regulatory guardrails as they grow.

The US CFTC fined Uniswap $175K (a):

In order to facilitate access to the protocol, Uniswap Labs developed and maintained a web interface…

Research and articles

The Forecasting Research Institute has a report on generating questions using conditional trees (see distilled as a tweet (a), blog post (a), or the full report (a))

On July, I missed a RAND publication on Fostering a Gender and Intersectional Perspective in EU Foresight (a). The document (a) contains an overview of EU institutions around foresight, and a discussion of how they fall short of mandated diversity goals.

A paper looks at whether prediction markets with expert participants are any good:

Some experiments have demonstrated the ability of relevant experts to engage with prediction markets and have allowed us to make a preliminary evaluation of whether the collective probability forecasts the markets generate are probabilistically calibrated, or reliable, in the terminology of meteorology.

Since 2018 we have run two dozen individual prediction markets for climate-related risks covering four topics: UK monthly temperatures and rainfall, the NINO3.4 sea surface temperature anomaly, Atlantic hurricane activity, and U.K. wheat yield

Phil Tetlock edited a book (a) on counterfactual histories.

Robin Hanson gave some more thoughts on Futarchy (a).

Vasco Grilo estimated that Factory-farming is as bad as one Holocaust every 2 days (a).

Nate Silver published a book (a). Here (a) is a long review from Andrew Gelman.

Ozzie Gooen—my former boss—has been playing around with using LLMs to automatically generate BOTECs: AutoSquiggle (a) (2 (a). It’s currently in beta and not very practical: it takes a few minutes to create a medium-sized model, which might not even run and might have to fixed manually. On the other hand, that model might have some ideas you hadn’t thought of, and even the current beta version might be neat as a pointer of what future forecasters might be able to do.

Someone at Goldman Sachs looked at the correlation between financial instruments and prediction market probabilities (a).

Odds and ends

Sentinel (a)—a team I’m running to anticipate and mitigate large-scale catastrophes—is still going strong. Rai Sur (a) has joined me as a cofounder. You can read our minutes for weeks #35 (a), #34 (a), #33 (a), #32 (a) and #31 (a), or follow up us on Twitter. As a medium-sized win, we outperformed Metaculus (a) by giving a 60% (a) to the WHO declaring monkeypox a public health emergency (a).

David Glidden is starting a forecasting meetup group (and hopefully network) with Pratik Chogule in Washington, DC 1 (a), 2 (a), 3 (a).

DC Forecasting & Prediction Markets Meetup. Thursday, Sept 26, 6:00pm – 9:00pm Union Pub, 201 Massachusetts Ave NE, Washington, DC 20002 RSVP: https://partiful.com/e/zpObY6EmiQEkgpcJB6Aw

A Senior person at US policy discussed the future of technology forecasting (a)

Vitalik Buterin defended (a) prediction markets.

538 updated their presidential forecast (a). However, the forecasting community generally considers it to be a bad model, since a) the original 538 model is gone with Nate Silver, and b) the model displays inconsistencies—like weighing polls much more after Biden dropped out—and generally signs of being gerrymandered/sloppy.

The usual test, whether that which any one maintains is merely his persuasion, or his subjective conviction at least, that is, his firm belief, is a bet. It frequently happens that a man delivers his opinions with so much boldness and assurance, that he appears to be under no apprehension as to the possibility of his being in error. The offer of a bet startles him, and makes him pause. Sometimes it turns out that his persuasion may be valued at a ducat, but not at ten. For he does not hesitate, perhaps, to venture a ducat, but if it is proposed to stake ten, he immediately becomes aware of the possibility of his being mistaken—a possibility which has hitherto escaped his observation. If we imagine to ourselves that we have to stake the happiness of our whole life on the truth of any proposition, our judgment drops its air of triumph, we take the alarm, and discover the actual strength of our belief. Thus pragmatical belief has degrees, varying in proportion to the interests at stake.

— Immanuel Kant, The Critique of Pure Reason (a)

This newsletter is sponsored by the Open Philanthropy Foundation.